To explain these theories, here is a brief introduction to the use of debits and credits, and how the technique of double-entry accounting came to be. The key is reporting fraud or theft as soon as you realize it has occurred. Your liability for fraudulent purchases is determined by the time frame in which it’s reported. Waiting too long to let the bank know that your card has been used for unauthorized purchases could result in you being held responsible for some or all losses.

In most cases, a debit card is a good choice when you want a convenient way to get cash out of your checking account or pay for purchases in full. A debit card is a payment card that makes payments by deducting money directly from a consumer’s checking account, rather than on-loan from a bank or card issuer. Debit cards offer the convenience of credit cards and many of the same consumer protections when issued by major payment processors such as Visa or Mastercard. You’re spending money from your bank account, not making purchases on credit (i.e., borrowing money).

Alert: highest cash back card we’ve seen now has 0% intro APR until nearly 2025

That said, today, most debit cards offer voluntary “zero liability” coverage. In addition, you can still lose money (albeit a small amount) with credit cards. With credit cards, you can’t lose more than $50 to fraud, but with debit cards, your liability is potentially Using Debit and Credit unlimited under federal law. Even though it’s called annual percentage rate, credit card interest is calculated daily. If you pay your credit card balance in full each month by the time your payment is due, you will generally not pay interest on regular transactions1.

All it takes is one error to throw off the books and resulting financial statements. This is why the task is best handled by software, such as NetSuite Cloud Accounting Software, which simplifies and automates many of the processes required by double-entry accounting. That includes recording debits and credits, as well as managing a company’s general ledger and chart of accounts.

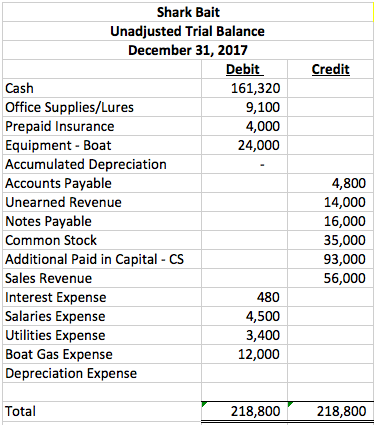

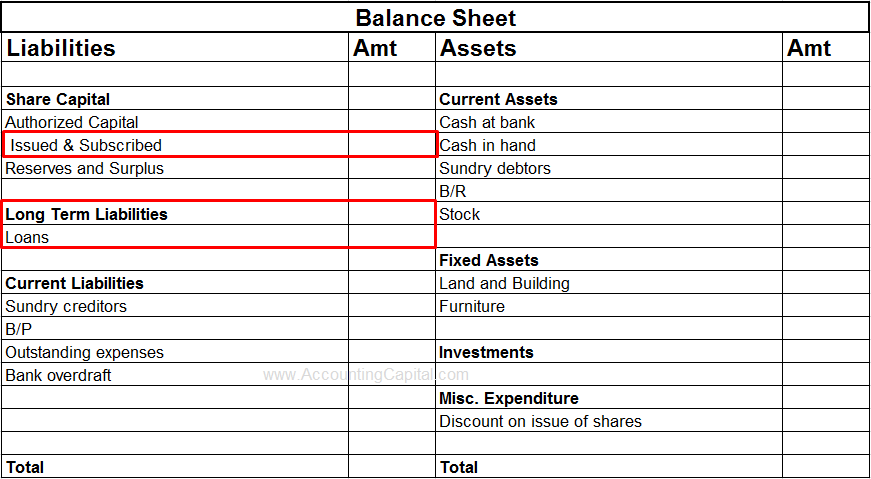

Account Types

Since your debit card is connected to your checking or spending account and you’re spending your own money when you make purchases with it, you aren’t increasing your debt. Like smartphones, both debit and credit cards are pretty much everywhere nowadays. Whether you’re shopping for a dog sweater online or getting your weekly groceries, you’d be hard-pressed to find any business that won’t accept both types of payments. Although, your favorite food truck or pop-up shop at the local flea market might only take cash.

What Is Credit Card Processing? – USA TODAY

What Is Credit Card Processing?.

Posted: Mon, 21 Aug 2023 09:17:00 GMT [source]

“I use my credit card for every possible purchase, whether it’s a $1 pack of gum at the gas station or a major home improvement with a contractor,” says Lowery. “The more I use my rewards cards, the bigger the bank of rewards I have to take my next vacation for free.” Many credit cards offer points, travel miles, or cash back on everyday purchases like groceries or gas. This one might seem obvious, but use your debit card to withdraw cash—again, make sure you’re aware of your surroundings at the ATM or go to an ATM in a bank to ensure your information is safe. You can use a credit card to withdraw cash, but it requires a cash advance—”a kind of transaction that often comes with fees as well as a high-interest rate,” says Lowery. You could also use your debit card at the grocery store and get cash back that way if you can’t get to an ATM.

You have a debit card with rewards

Furthermore, some merchants may process an initial “soft” authorization, where they put a hold on a small amount, like a dollar, and then process the actual transaction once the sale is finalized. In addition, for certain types of services, like rental cars and hotel stays, the merchant might require a deposit, which can reduce your available balance. Credit cards allow you to borrow money from a financial services company to pay for items or services. When you use one, the card issuer pays the recipient on your behalf, and you later repay the card issuer.

From the bank’s point of view, your credit card account is the bank’s asset. Hence, using a debit card or credit card causes a debit to the cardholder’s account in either situation when viewed from the bank’s perspective. The purchase translates to a $10,000 increase in equipment (an asset) and a $10,000 increase in accounts payable (a liability) for money owed. The accounts payable account will be debited to remove the liability, and the cash account will be credited to reflect payment.

When to Use Debits vs. Credits in Accounting

If you find this fee on your account statements or in the account’s terms, you may want to switch to one of the many banks or credit unions that offer a debit card without a purchase transaction fee. With credit card transactions, the payment is processed through the credit card company. There are specific fees merchants must pay credit card companies and credit card service companies, resulting in higher fees.

Now it’s time to update his company’s online accounting information. T accounts are simply graphic representations of a ledger account. Debits and credits are recorded in your business’s general ledger. A general ledger includes a complete record of all financial transactions for a period of time. Although they’re not as common, some debit cards have rewards programs.

The role of a debit card

A debit reflects money coming into a business’s account, which is why it is a positive. The term debit comes from the word debitum, meaning “what is due,” and credit comes from creditum, defined as “something entrusted to another or a loan.” Again, equal but opposite means if you increase one account, you need to decrease the other account and vice versa.

If you’re putting something on credit, odds are, you don’t have the money to cover it from your own bank account. And if you don’t have the money right now to buy something, you shouldn’t buy it. A credit card borrows money from a lender to cover a purchase instead of using your own money.

Because they are both asset accounts, your Inventory account increases with the debit while your Cash account decreases with a credit. The journal entry “ABC Computers” is indented to indicate that this is the credit transaction. It is accepted accounting practice to indent credit transactions recorded within a journal.

- As long as you use it responsibly, charging everyday purchases to your credit card is perfectly fine—in fact, it can be the key to building credit and boosting your credit score.

- For example, debits and credits in quickbooks allow the system to make sense to the accountant as well as the untrained record-keeper.

- When you carry a balance on your card, you’re charged a daily percentage of your total APR.

Although there are times when you may need cash, your debit card can largely take the place of cash, so you don’t have to worry about misplacing your money. If you misplace your debit card, you can use Card Management within online and mobile banking to turn your card off so that no unauthorized transactions can be made. Remember, you can help lower your risk of identity theft just by keeping an eye on your bank account. If you’re checking your transactions often (which you should be doing if you’re budgeting), then you’ll be able to catch any unusual purchases pretty quick. A lot of people think credit cards are the only way to avoid the hassle when trying to book a flight, reserve a hotel room, or rent a car.

There is no upper limit to the number of accounts involved in a transaction – but the minimum is no less than two accounts. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. A debit card looks like a credit card but works like an electronic check.